During a conference held in Sao Paulo last week (25 June) by the Brazilian Chapter of the

Turnaround Management Association (TMA Brasil), Brazilian[1] and North American[2]

restructuring experts weighed in on the domestic bankruptcy legal framework in contrast

to other jurisdictions, and the reasons that have been leading Brazilian – and other Latin

American – companies to file for bankruptcy in the US. Debtwire senior legal analyst Arthur

Almeida was in attendance, and distills below the pivotal takeaways from the event.

Deciding where to file – legal certainty makes a difference, despite the costs

Panelists started the event by highlighting the predictability and effectiveness of the

restructuring tools existing under the US Bankruptcy Code (USBC), which entice many

domestic and foreign distressed companies to look to restructure their debt in the US.

Specifically, the automatic stay and the possibility of accessing a huge market of post-

petition financing were mentioned among the features that attract foreign companies to

turn to Chapter 11 and the oversight of experienced US bankruptcy courts.

According to the specialists, an established[3] set of well-tested rules provides additional

legal certainty and safeguards that (i) protect distressed companies and (ii) provide

impaired creditors with means for protecting themselves against receiving unequal

treatment. In addition, the depth of knowledge and expertise of US bankruptcy court

judges, which are often former restructuring attorneys with decades of experience, was

cited as another factor contributing to the success of the US bankruptcy system worldwide.

Furthermore, the foreigner-friendly approach[4] of the USBC incentivizes companies

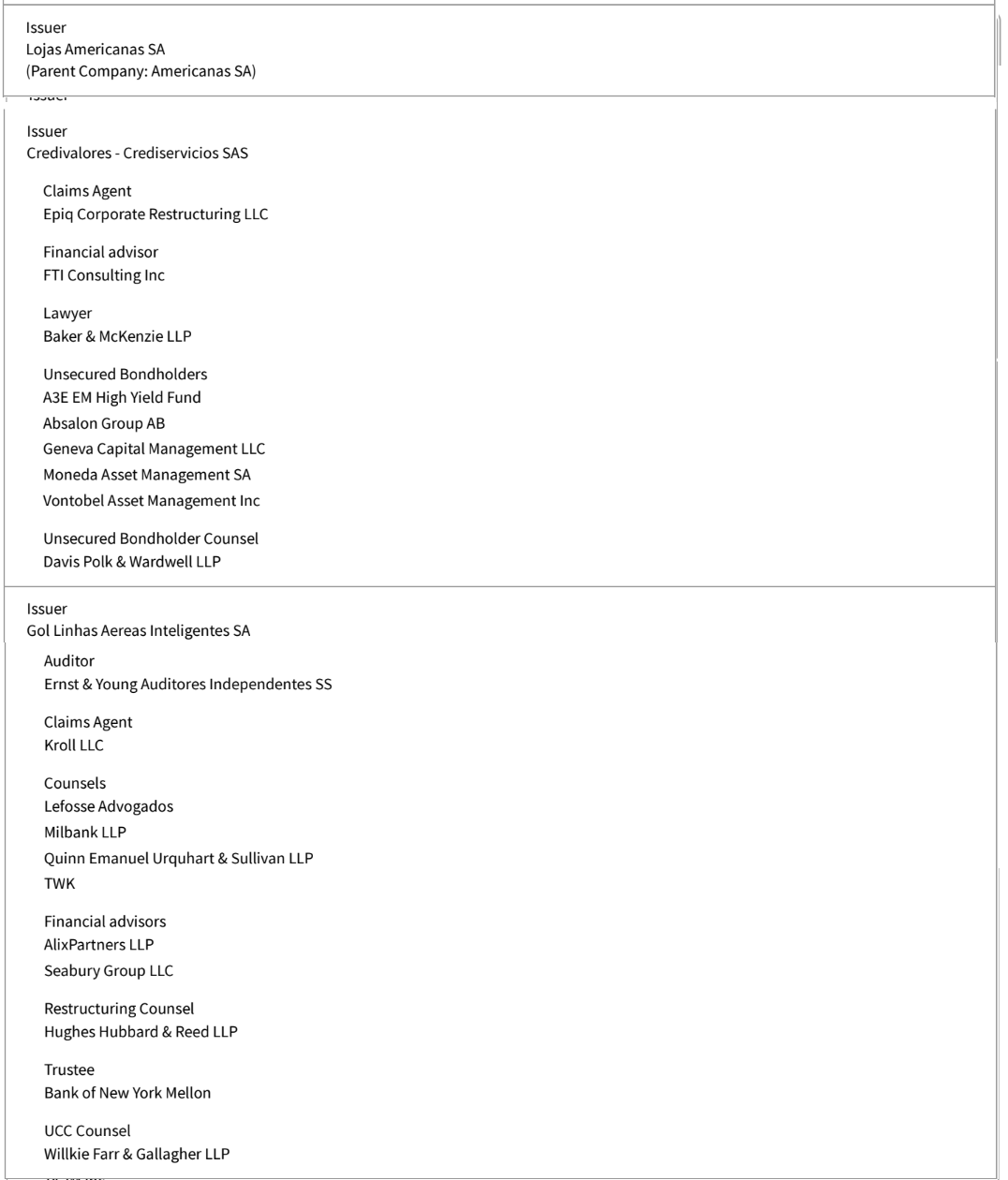

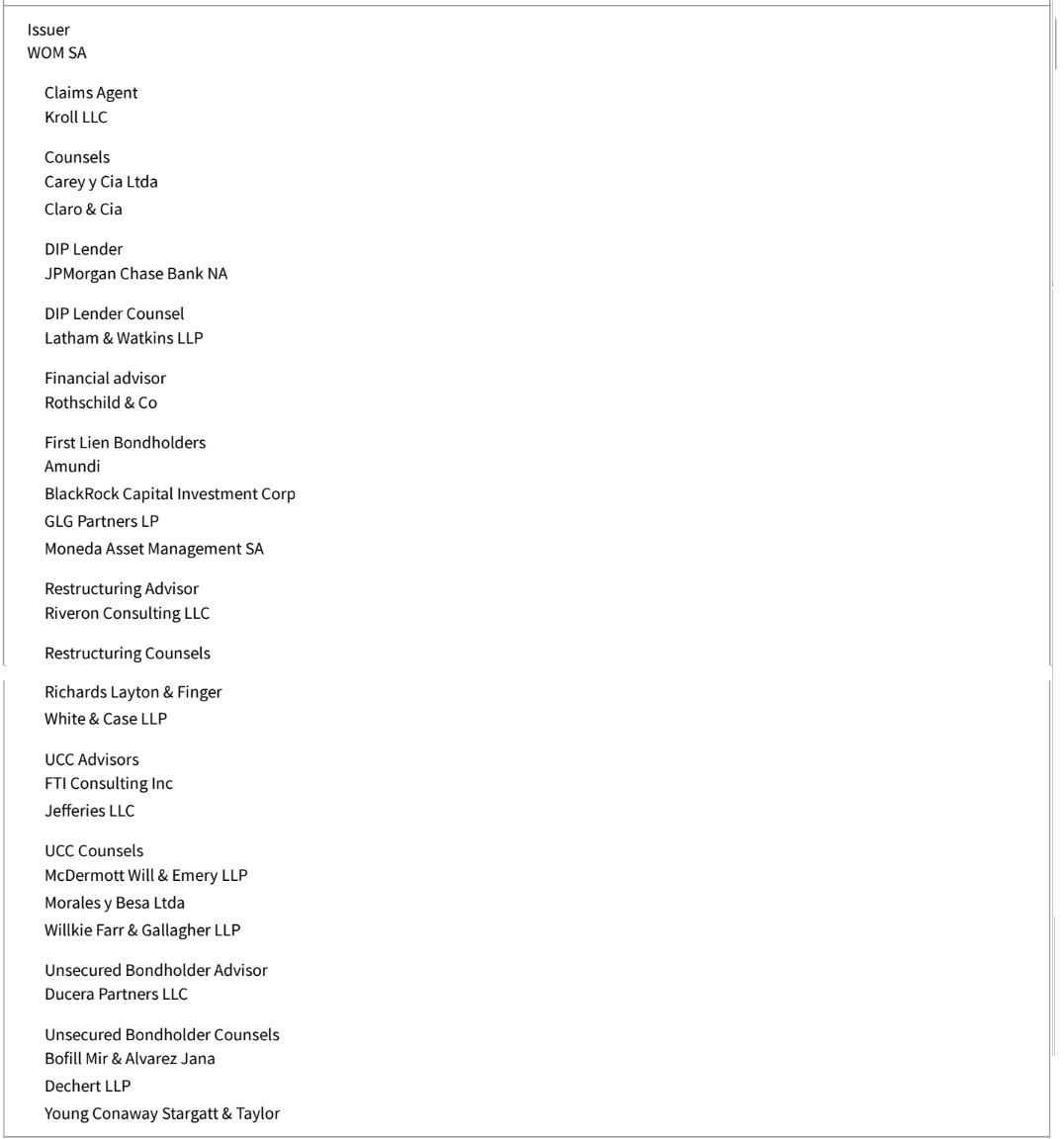

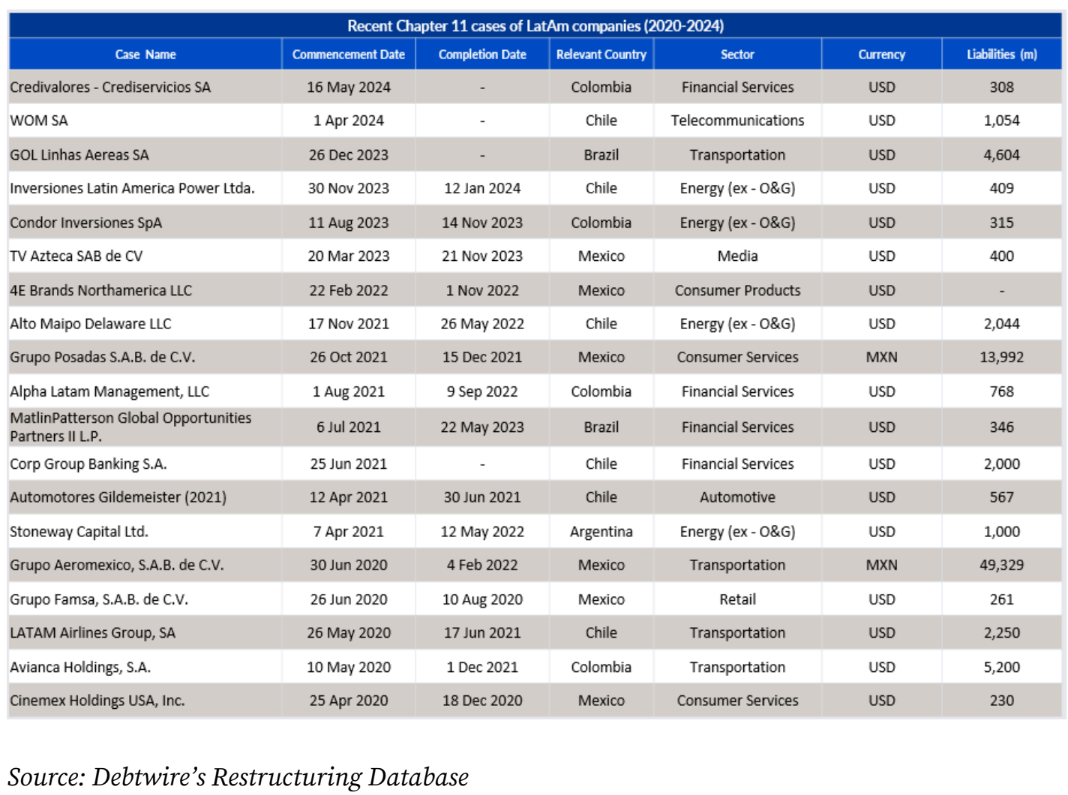

incorporated abroad to commence voluntary Chapter 11 cases. Recent examples include

Brazilian airline Gol Linhas Aereas, Chilean telecommunications company WOM SA, and

Colombian non-bank financial services firm Credivalores-Crediservicios SA.

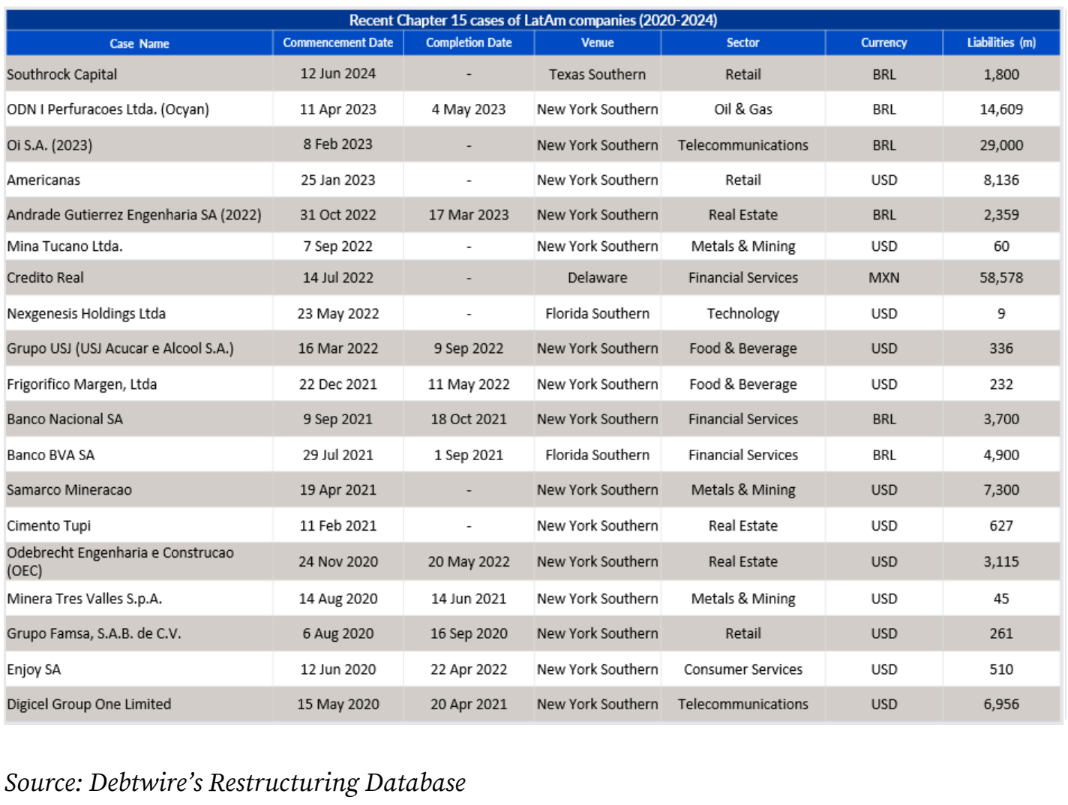

Also, by adopting the UNCITRAL Model Law on cross-border insolvency in 2005, the US

bankruptcy framework allows foreign companies to make domestic in-court restructurings

enforceable in the US via streamlined Chapter 15 recognition proceedings, thereby

providing further options and motivation to the forum choice. In practice, recognition

under Chapter 15 allows non-US debtors to bind international creditors by protecting

assets located in the US territory so that they may be administered in accordance with the

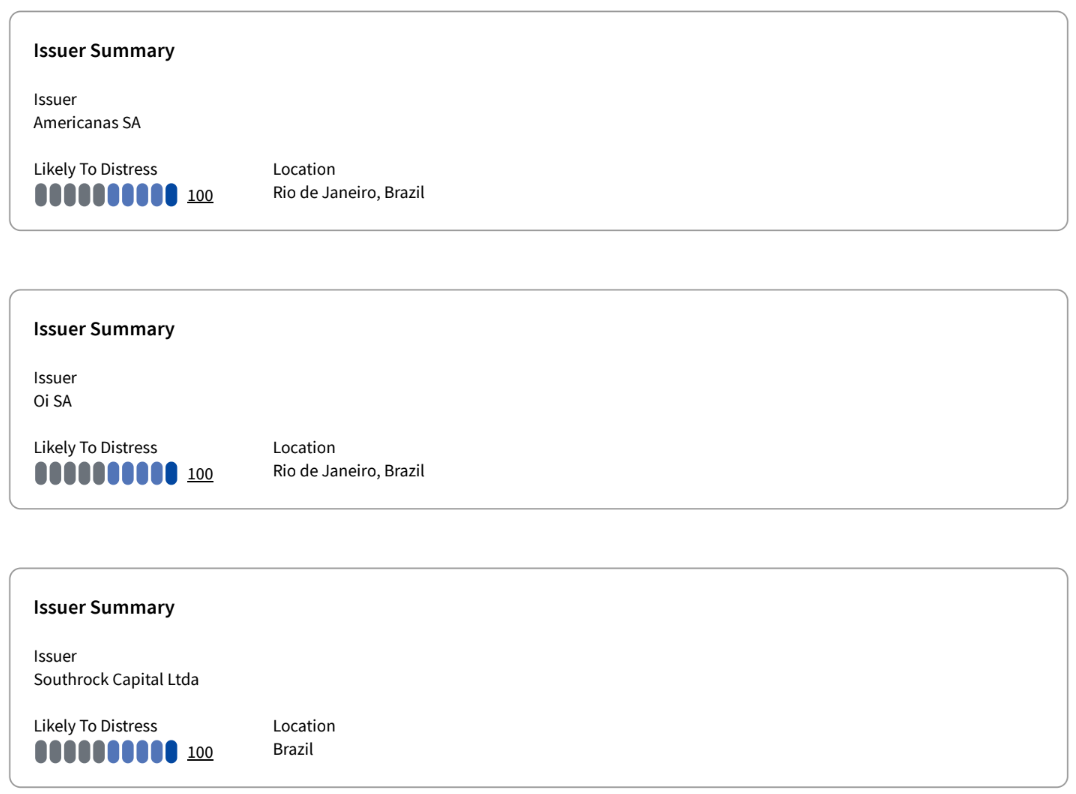

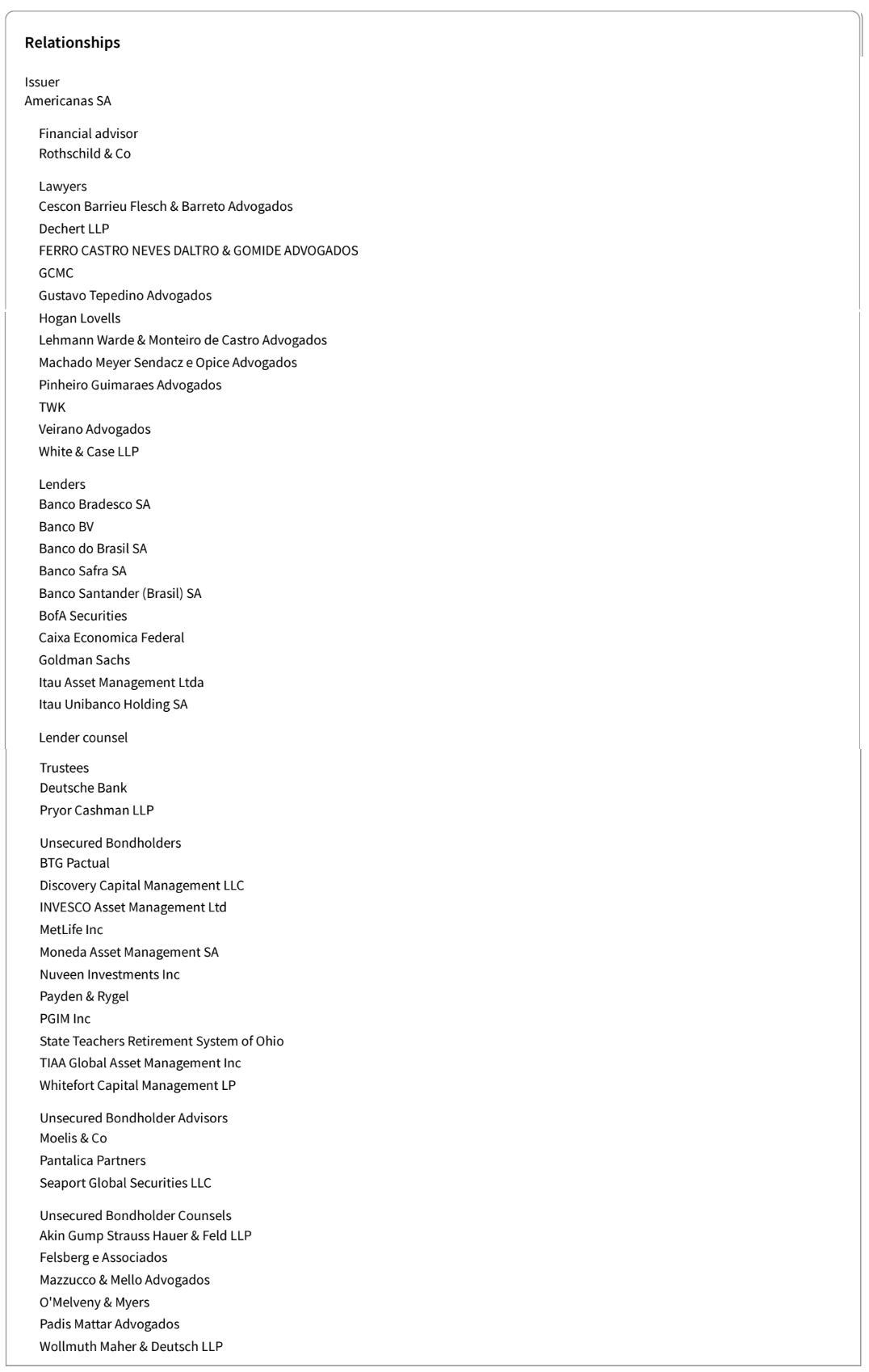

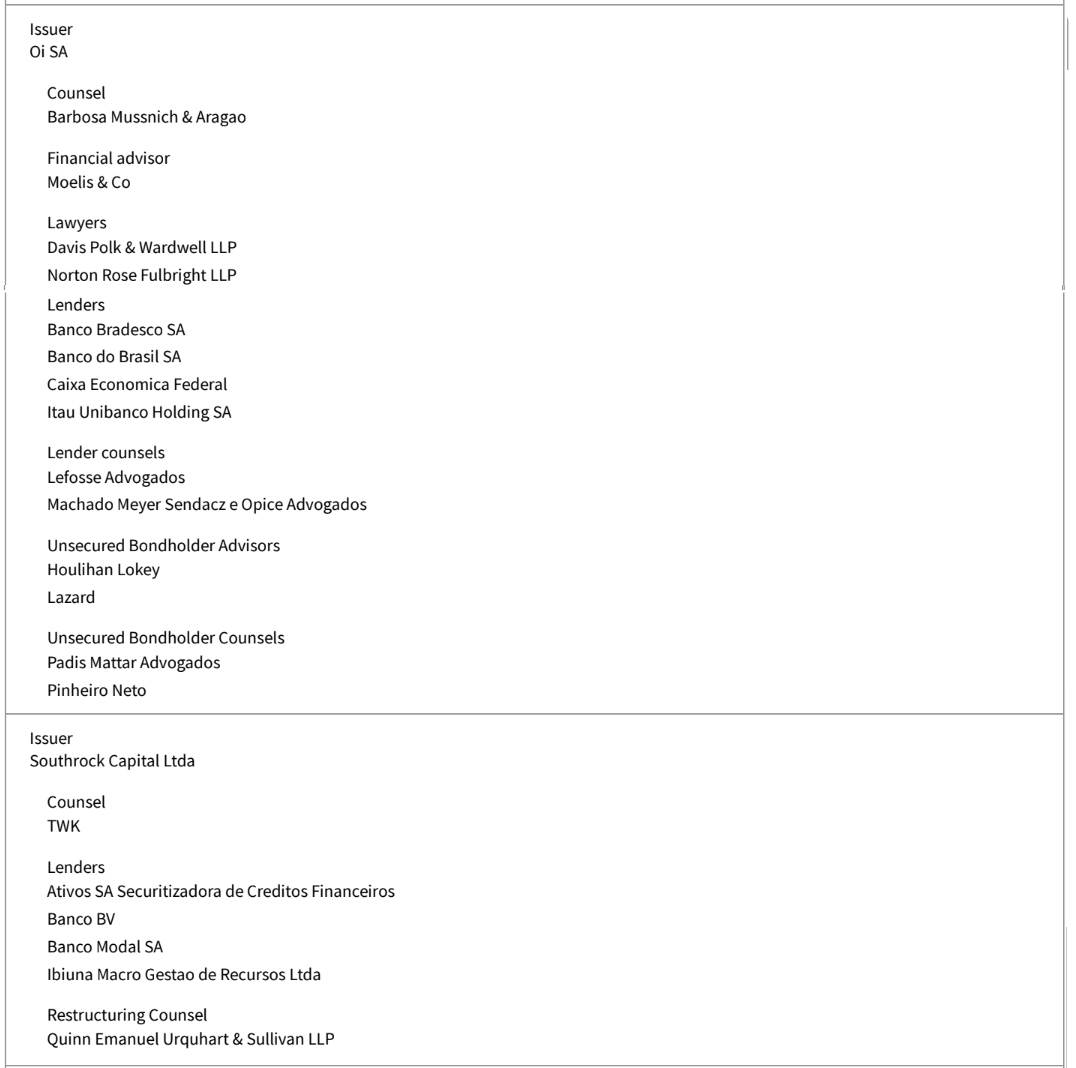

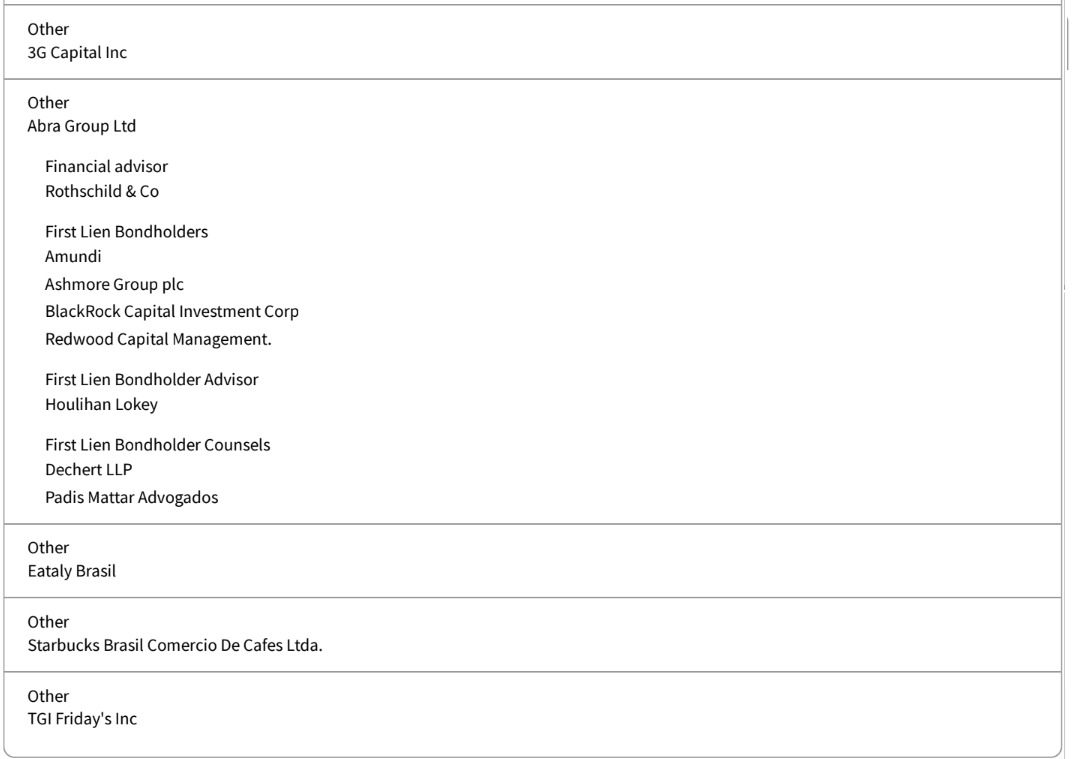

terms of an approved restructuring plan. This strategy was recently adopted by Brazilian

companies Southrock Capital, Oi SA and Americanas SA, among others.

On the flip side, bankruptcy-related costs were mentioned by the specialists as the main

downside of filing for bankruptcy in the US, and one of the factors that could disincentivize

companies seeking court oversight to implement a financial turnaround in that

jurisdiction. In short, restructuring in the US is effective, but it may be also expensive,

panelists noted.

In contrast, Brazilian governing bankruptcy law became valid in mid-2005, and was

centered around the principle of company preservation. Specifically, Section 47 focuses on

preservation of the economic activity and the public interest resulting from reorganization

processes, such as the maintenance of jobs, tax collection and circulation of goods,

products and services, as well as the rights of creditors.

Panelists explained that the goal was to replace a system that governed insolvency law for

almost six decades, in which distressed companies had, in practice, very few chances to

emerge from financial crises, with a more attractive insolvency legal framework for

debtors and creditors that would incentivize both foreign and domestic companies to

commence reorganization proceedings in Brazil.

A relatively recent initiative to create specialized bankruptcy courts (which has not yet

reached all districts of the country), along with a major law reform that was passed in early

2021, have both contributed to the development of the country’s insolvency regime,

panelists said. However, it takes some time for case law to develop and for practitioners to

become familiar with novel, complex statutory guidance, by either fixing mistakes or

filling in gaps in the law.

In the meantime, a controversial bill for another large reform in the bankruptcy law was

recently approved by the country’s Lower House and is currently pending with the Senate.

The Brazilian Panelists praised the original ideas of the bill, centered mainly around

proposals to improve the liquidation proceeding via increasing the power of creditors, but

strongly criticized the amended version that was approved by the Chamber of

Representatives, which introduced several new items related to both liquidation and

reorganization proceedings, and the role of judicial managers.

Further discussions included the benefits and disadvantages of filing for bankruptcy to

restructure defaulted debt in Brazil, rather than implementing out-of-court renegotiations

to emerge from financial crises, with special emphasis on the role of local courts to bridge

a gap among stakeholders.

Among other topics related to this issue, the panelists commented on the pros and cons

regarding asset sales, noting that companies undergoing an in-court restructuring process

lose their autonomy and need to obtain court authorization to sell their assets. On the other

hand, filing for bankruptcy allows distressed companies to segregate part of their assets as

an Isolated Business Unit and sell that unit via auction proceedings free of charges and

liabilities for the purchaser, provided that certain law requirements are achieved.

In this context, the panelists concluded the event mentioning that some reorganization

proceedings are filed not only to restructure defaulted claims, but also to implement

substantial asset sales under more attractive conditions for potential investors.

Footnotes:

[1] Isabel Picot, partner at Galdino & Coelho, Pimenta, Takemi, Ayoub Advogados;

Francisco Satiro, naming partner at Satiro Advogados and Professor at Universidade de Sao

Paulo (USP); Fabiana Solano, partner at Felsberg Advogados; and Adriana Pugliesi,

Professor at CEU Law School and at Fundacao Getulio Vargas (FGV).

[2] Rachel Smiley, Chair at Ferguson Braswell Fraser Kubasta PC Law and the 2024 TMA

Global President-Elect; and Scott Y. Stuart, TMA Global CEO.

[3] The USBC was passed in 1978.

[4] The USBC allows every person or corporation that resides or has a domicile, a place of

business, or property in the US to file for bankruptcy. In addition, the “property

requirement” typically serves as the jurisdictional hook for foreign debtors, as it may be

easily satisfied by the mere opening of a bank account prior to the bankruptcy filing, or

even by the transfer of the retainer fees to the US lawyer that will represent the debtor in

the debt restructuring proceeding.

by Arthur Almeida, with RDB charts by Jayjeet Sharma

Arthur Almeida is a former restructuring attorney. Prior to joining Debtwire as a Legal Analyst,

he practiced with Passos & Sticca Advogados Associados, and worked in the legal department of

Banco Fibra S.A. Arthur’s experience includes participating in major civil litigation on credit

recovery, representing creditors such as banks and financial institutions in high-profile

restructurings. He also obtained his LL.M in Financial and Capital Markets Law from Insper

Instituto de Ensino e Pesquisa, and is currently enrolled in the Master's Program in Commercial

Law at Universidade de Sao Paulo.

Any opinion, analysis or information provided in this article is not intended, nor should be

construed, as legal advice, including, but not limited to, investment advice as defined by the

Investment Company Act of 1940. Debtwire does not provide any legal advice and subscribers

should consult with their own legal counsel for matters requiring legal advice.